Whenever a market is hot, this real estate brokerage model increasingly pops up. The idea is simple, they compete on commission and results. To be clear, there is no set standard for commissions. It is whatever is agreed upon between a Seller and real estate agent. Typically, it is between 5%-6%, where that amount is split usually in half between the listing agent and the agent that brings the buyer.

Now, I do want to preface this article with that some Sellers have had success with discount brokers, and we should be happy for their success. It works for some. Every market is different, and every scenario is different. For example, there may be a Seller that is overleveraged on their mortgage versus the value of the home and might need that discount broker because they don’t have the margins to sell through a traditional brokerage. Furthermore, there have been reports that discount brokers, although the homes took longer to sell, the sold prices were similar average prices with traditional brokerages. However, those reports were from 2007 before the housing market crashed. At that time, anyone with a pulse could qualify for a mortgage and times have changed. There are new regulations in place, new buyer and Seller behaviors, and different lender requirements.

In this article, we are going to dig into a few various aspects of the discount broker model, including a case study from my personal experience.

How does the Discount Model Work?

For discount brokers, their models are typically a few ways. The first is a flat fee. It might be something in the realm of $95 and they just give the Seller access to post their home into the Multiple Listing Service (MLS). The second model is the low percentage such as 1% for the listing side. The idea behind it is the Seller nets more money assuming they get the same price as if they were to sell with a traditional agent. Sometimes there will even be a discounted or flat fee rate on the buy side as well. They use licensed agents, however this model does not attract or retain the best agent (as you will see later on in this article with evidence).

Examples of Discount Brokers

Let’s first look at discount brokers as a category within the profession. It is an extremely easy model to get behind. The discount broker is making it up on volume and by undercutting the “average” agent, they hope to gain market share. But is it sustainable? Let’s dive into a few companies who follow this model.

The first is PurpleBricks. Does the company ring a bell? If it doesn’t, it’s because they went out of business here in the California after just a few short years. Starting in Southern California in 2017, they exited by 2019. They are a UK based company that is all about providing a discounted rate. In the UK they start at £999.Their model in the U.S. was to charge clients a flat fee of $3,200 to represent them. The catch was that the Seller would be charged the fee whether the home sold. They also shut their doors in Australia. From the Orange County Register, “According to published reports, publicly-traded Purplebricks’ stock had lost 75% of its value in the 22 months since it announced its expansion. In its most recent fiscal year, the company reported an operating loss from its U.S. and Australian expansion of $42.9 million. The American operations contributed only 2% of Purplebricks’ total revenue.”

The second company to review is REX Real Estate. They tote that they don’t need access to the MLS because they use technology to drive buyer traffic in and therefore can pass the savings on to the Seller. They typically charge 2.5% total, half of what a typical agent might charge. But here is where it gets interesting.

Assuming you go with their lowest cost option (which is the whole point of using a discount broker), they aren’t going to cooperate with a Buyer’s Agent unless someone (typically coming out of the Seller net proceeds), pays them. In theory the buyer could pay the commission, but that is assuming (1) the buyer wants to when there are other homes on the market where they don’t have to or (2) the purchase price is reflected accordingly. Because of this, it limits the pool of buyers who are using agents (which is the majority). This also means that the listing agent is likely to be performing what is called “dual agency.” This is when the agent represents both sides. Although legal, it does mean the agent must become a neutral party and not showing favoritism to either the Buyer or Seller. This means the Seller just lost their representation. Dual agency isn’t always a terrible thing, it is just something to be aware of.

The other thing to keep in mind with REX is that the real estate community does not think fondly of them. There are many lawsuits that happened in recent history related to REX. The main one that directly affect Sellers is with Zillow. REX sued Zillow alleging an antitrust conspiracy with the listing site and the National Association of Realtors. Zillow had created a separate category of homes for Rex to be categorized in for their listings. That gave their listings a huge disadvantage because the average consumer doesn’t notice it. Look at the screenshot below:

After much back and forth, the judge ruled in favor of Zillow, stating that Zillow has done their duty of displaying the listings and explaining the differences in their FAQ page. More can be read about it in an article published by Housing Wire. This is just on Zillow. Because many other public-facing real estate websites are getting their listings direct from the Multiple Listing Service, many REX listings may not be coming up. As a Seller, the intention is to get the most exposure for the home to get the best price and terms. If buyers don’t see it, how can one get the results?

The third to discuss is the most successful one, which is Redfin. Redfin’s model is providing discounted listing commissions and even provide commission rebates on the buy side and toting as the “technology” brokerage. As a company, they have not been doing well in recent months. 2020-2021 were great years for many agents, which is evident in their stock price. But it looks like 2022 is not looking so good. Over the last five years, their stock price on average has gone down 7.24%. They have very high turnover of agents, as constantly mentioned in reviews on Simply Hired.

Although we don’t know what’s happening behind the scenes, this can be a telling sign that either (1) they are in trouble or (2) their stock price is beginning to normalize to pre-pandemic levels. Their market share is also in the range of 1.15%, which is a hair lower than what it was in previous quarters. According to Seeking Alpha, Redfin is running into many concerns, including venturing into “Redfin Now,” a program similar to Zillow’s iBuying program, which failed miserably. The article also notes that Refin website views are down, which is a major play for the company. But why does all of this concern a potential Seller? Well, because a Seller wants to work with a company that’s going to succeed and have eyeballs on it’s website, which is one of their major selling points, right? Otherwise they are no different than any other brokerage out there.

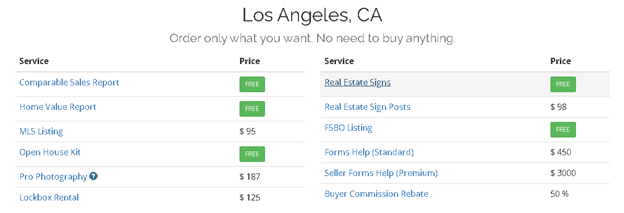

The fourth example is a flat fee service geared towards For Sale by Owner enthusiasts, HomeCoin.com. They advertise a $95 flat fee service to the Seller to post in the MLS. However, that’s just the starting price. Depending on location, they add on fees depending on what you want to include. This is what it showed when I inputted 91403 as of March 30, 2022.

The disclosures are important and not something to go cheap on. If you don’t disclose something properly, you are up for a lawsuit. So really the total bill to use their service is $3,955 and that doesn’t include the buyer’s side commission.

To make the discount model work, one strategy they employ is to automate and outsource as much as possible. For example, I scheduled a showing that was listed with them for a property in Ventura County (which was one of the hottest markets at the time). To do it, I had to call a generic number (not the agent) and go through an entire process of answering basic questions about me, my license number, the property address, and more just to find out it was on a lock box. A text message to the listing agent could have sufficed. This can create a barrier issue for those with a lack of patience. Studies show a consumer drops off by 50% for each step that it takes to complete a task (thus why Amazon has a “Buy Now” button on their website). The same could apply here. An agent could say they couldn’t get a hold of the listing agent, or a prospective buyer could have trouble scheduling a showing. I then saw it again with my wife as we were considering purchasing it at a steep discount knowing that it had been sitting on the market. From the Seller’s and Listing Agent’s perspective, that’s two showings with the same agent. At no point did the agent follow up with me. I had to be in communication with the agent. That house never sold, even though it wasn’t badly priced to begin with and after I reached out, the Listing Agent disclosed that the Seller was willing to take a discount on the price. Even though the house was vacant, it was a mess. There was debris everywhere and was a poor presentation of the home. My clients viewed the home as a fixer, even though it just needed to be cleaned up with a few repairs on the inside. The roof needed work but could have been mitigated with a roof warranty for a year and then replaced after saving up.

The last option is of course an agent in a traditional office that goes to a discount model. In other words, an agent with Keller Williams, Coldwell Banker, Century 21, etc. can provide the listing service at a 1% or a flat fee. The issue here is from the agent perspective, the numbers don’t really pencil out in the long run. Here is an example:

- $500,000 condominium sale

- One percent commission: $5,000

- After broker split (varies between agent and broker but let’s say 70%/30%): $3,500

- After taxes (assuming 30% income tax): $2,450

None of this includes insurance, photographer, MLS fees, car expenses, or anything else related to the cost of doing business. So, the concern is twofold. On one side is from the agent perspective, which is, “is the business model sustainable?” Even if an agent develops a decent sized book of business (the name of the game is volume), it will need to be substantial enough to create a support staff because the time it takes to sell a home with the paperwork and everything is the same, regardless of what you charge (assuming you do it right). But on the other side, something would have to give on the listing to make the margins work. This means cell phone photos versus professional photographer, lockbox versus private showings (which don’t get me wrong, lockboxes do have their place and I’ve used them as well). It means to sell the home would require lower quality service and worse presentation. That can result in a lower sales price, which means less cash for the Seller.

So, what if an Agent wants to make it up on Volume? Who cares as a Seller?

I’ve had this objection before. If the Seller gets a decent price, who cares what the agent’s business model is? The problem is, because the dollar amount is lower, it makes it harder to be a priority for the agent. When dealing with condominiums that are averaging $500,000 or homes averaging $1,000,000, this can be the biggest investment in a Seller’s life. It would make logical sense to want the listing to be a priority for a Seller.

Another way to look at it is the price per commission or flat fee ratio is nominal, making it less incentivizing for the listing agent to get the Seller the best price and terms. For example, a Seller has two offers, one at $975,000 cash and one at $1,000,000 financing. A good agent would take the time to dig into the loan side of things such as making sure it could appraise, how well qualified are the buyers, and even take the time to negotiate with the cash buyer to bring them up in price and get contingencies released ahead of time (such as disclosures). Let’s say that process takes additional three days to do the extra work and approximately five hours (between phone calls and strategy sessions). Between a flat fee broker, discounted broker, and full service, let’s break down the difference:

- Flat Fee: Agent makes no more money doing the extra work. Therefore, they are better off encouraging the Seller to take the $975,000 cash and move on. Waiting the extra three days financially hurts them because they need the cash to move on to the next listing.

- Discount Broker: Assuming 1%, that would be a difference of $250 before taxes, broker splits, and expenses. Forgetting expenses and broker splits, just taking 30% off the top for taxes means the agent brings home around $175.

- Full Service: Assuming 2.5% that would be $625. After tax, which would be around $437.50.

Although every agent is different and they are technically supposed to have a fiduciary responsibility to the Seller, the discount broker might immediately go for the cash offer. It’s a volume game so they need the home to sell quickly and move on.

Of course, as the Seller you can ask the agent to go the extra mile and they would have to. But don’t be surprised if (1) they don’t volunteer it and (2) they push back on the extra work.

Case Study: Discount vs. Full Service

Even in hot markets, not all homes sell. Typically, there are two reasons a home doesn’t sell. The first is price, and the second is the agent. I discuss more in my YouTube video, which can be found here. So, let’s discuss the later of the two in a “real world” example.

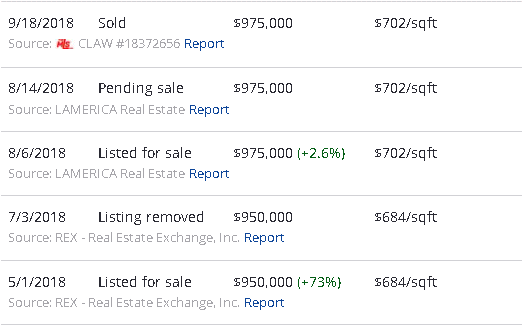

1173 S. Muirfield Road is a duplex originally listed by REX Real Estate at $950,000. For two months it sat. According to the Sellers, they had no showings, which means of course, no offers. It wasn’t in the MLS, as that was part of the discount model. Fast forward to when I took over the listing. I listed it for $975,000, took professional photos, floor plans, and even did a home inspection to avoid a re-negotiation once under contract (all at our cost, not the Sellers). I also did extensive paid marketing outreach. Within eight days of being on the market, we were in escrow at full price with no inspection contingency. We did have multiple showings in a matter of days and did receive three offers. We had one offer over asking but the one at list price was at better terms.

Below is the timeline, which can be found on Zillow.

So, is Full Service always the Way to Go?

The argument from some discount brokers is there is no guarantee that you are going to get better service from a “full paid” agent. They are 100% right. There are agents out there who collect the full 2.5% for their side but don’t provide the level of service you would expect considering how much they are getting paid.

That’s why the Seller needs to do the right vetting. Asking questions such as the following:

- Is my property going to be a priority?

- What marketing efforts are you going to do? Photography, videography, floor plans, etc.?

- Do you always go with the highest price?

- Will you be there for showings?

- Are you posting online such as social media and other platforms?

- Will I be working with you directly or am I being put through a system or with a team member?

It’s really all about the agent, not the brokerage, discount or not. So before deciding if you want to go with the discounted broker or full service, ask yourself five questions and that will decide which route you go:

- Do you value your property as a high-priced investment?

- Do you want the best price and terms for your property?

- Do you want an agent that is going to take the sale of your property seriously and as a priority?

- Do you want an agent that will take the time to go over the paperwork, review disclosures, and produce strategies and recommendations?

- Are you okay with getting what you pay for, and the risks involved if you go with a discounted broker?

To be frank, Real Estate Agents need an image makeover. The barrier to entry is low, training in many offices is either non-existent or the new agent must pay a premium for the training, and there are false promises of making a fortune. The initial license to represent clients is identified as a “salesperson’s license.” Many people view Realtors as the stereotypical car salespeople. That’s a problem considering that they are handling transactions that involve pages upon pages of legal paperwork where the wording of one sentence can completely change the outcome of a deal. On top of all of that, an agent is managing the transaction of assets that can total millions of dollars. Attorneys require seven years of total education. Doctors require ten years of education. Real Estate Agents require a few months. The great part about the low barrier to entry is that it does open the door of opportunity for people to become successful in a career where if you work hard and smart, it can pay off. On the other side of the coin, it’s viewed as a low level and low priority profession and therefore opens the opportunity for disruptors to come in and give off the impression that this isn’t as big a deal as it should be.

In the long run I don’t think discount brokers are going away but I also don’t believe they will replace the traditional model. They don’t have major market share and is unlikely they ever will. As transactions get more complicated, buyers and sellers will start to learn and understand the importance and be willing to pay for it. What we are also seeing is although the barrier to entry to get the license is low, the actual barrier to get into the business itself is getting more difficult. Getting clients, having offers accepted, and obtaining listings is much harder now than it was before. Even on the agent side as they start to realize how difficult it is in the business; they won’t be able to afford the low pay per transaction considering the conversion rates are getting lower, but costs are going up (just look at gas alone after six months of doing showings for clients). They will have to charge more to keep up. Studies are also showing that top producing agents are just gaining more market share. This tells us that people understand value and results.

Time will tell and it is important that if a seller is on the fence about selling with one model over another, then interviewing different agents is an effective way to find out what works for their situation. But understand that you get what you pay for, and results will vary.

No responses yet