I meet all sorts of investors from “house hackers” to just traditional buy and hold. However, I consistently hear the same thing, “I plan on investing out of state.” The reasons are typically twofold:

- Prices: The barrier to entry in Los Angeles is high. Finding a single-family home under $500,000 in the general Los Angeles area is close to impossible unless it such a fixer to the point where it is either uninhabitable or straight up tear down.

- Rent Control Laws: Whether you are for or against rent control, it’s challenging for investors and you can invest elsewhere and not have to deal with it. Filling out paperwork, paying fees to the City, not being able to raise rents to market rates, and more is not fulfilling and frankly, annoying. It is strictly a business decision.

However, there are some exceptionally good logical reasons to invest in Los Angeles that not everyone thinks about. Here are a few reasons why I personally invest in Los Angeles/So Cal area and intend to continue for the foreseeable future:

- Unlocking future income: Think about it. Right now, I have about $5,000 a month in mortgages between my rentals. My tenants are covering all or most (remember, I’m house hacking one of them). Because owning property is a long-term play, by the time I’m ready to retire, the properties will be paid off. That’s unlocking $60,000 a year in income off two properties/three doors. And best yet, that doesn’t account for appreciation. To do that in the Midwest, you might need as many as 5-10 properties/doors to do the same thing. So, you must manage double the tenants/properties to get the same result.

- Rents are forecasted to increase: Some investors are leaving California for the reasons mentioned above. This will keep inventory low. That means for those willing to stick around will be the only options for tenants. It can result in little to no push back on raising rents on existing tenants and allows you to be picky when choosing new ones.

- People moving here have money: Yes, there are more people leaving Los Angeles County than moving in. For now, that’s fine because we don’t have the inventory to sustain them anyways. But, according to How Money Walks, people are moving in from areas such as San Francisco and New York City. Both of which are more expensive than Los Angeles. We are an affordable option when comparing and that is with the high rents.

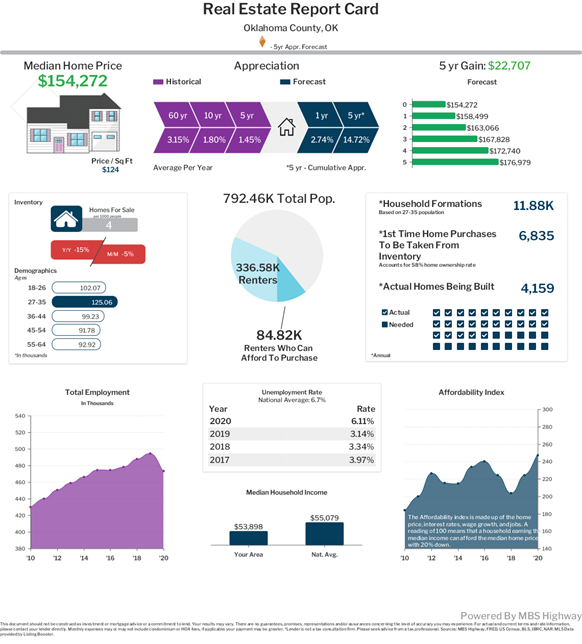

- Overall appreciation: I always tell my house hackers and investors to not bank on appreciation. However, that doesn’t mean you can’t take it into consideration. Los Angeles is positioned to do well, even though more people are leaving the County than coming in. The population is forecasted to increase through births. Household formation is forecasted to increase. Look at the information below provided by MBS Highway. They take data from the US Census, current unemployment rates, Federal Reserve, National Association of Realtors, and more to determine projected appreciation over the next 1-5 years.

Now, compare it to another location like Clark County, Nevada (where Las Vegas is and where a lot of people are considering):

Or take Oklahoma County, where Oklahoma City is and where the average home price is $154,272:

The Los Angeles area is poised to do much better than either of those areas. With higher prices means more opportunity to leverage, such as lines of credit or resale to purchase more investment properties. Furthermore, if you take the average rent appreciation of 3% in each of these counties, your cash flow will increase higher in LA than other areas by virtue of dealing with larger numbers.

So, although Los Angeles might not seem enticing for investors, there is actually a lot of opportunity. Keep in mind there isn’t more land to build, which will keep inventory down (versus areas like Vegas where there are stretches of vacant land). Like most investing, it is a long-term play. If your concern is pricing, then you can always start off with house hacking (renting out rooms or units in your primary residence) to get you started. That’s how many investors (including myself) are getting started and we hope to see profitable results in the short and long term.

No responses yet