Some buyers in the Los Angeles area are waiting. What are they waiting for? The big crash. The wave of foreclosures that are looming over us and bound to happen. But is it? There is plenty of data showing why there will be an increase in inventory over the next 15 months. Everything from businesses closing to people reevaluating their home situation. But that doesn’t mean crashing prices and rising foreclosures. The thought process is with so many Americans in forbearance, that is going to expire around the second or third quarter of 2021 for some, homeowners are going to have to make a choice: pay up or get foreclosed on. Just for the record, there has been consistent decrease in number of forbearance cases (see chart below).

Here are five reasons why we may not see massive foreclosures and more importantly, price drops:

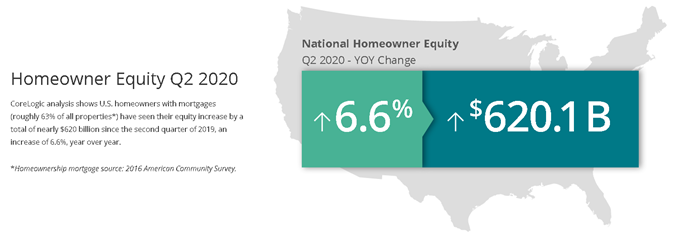

1) Majority of American households have equity. According to CoreLogic, the national homeowner equity rose by 6.6% in the second quarter. Because of this, even if a homeowner goes into forbearance and must make a choice, they are better off selling as a traditional sale rather than go through the foreclosure route and have that on their record. They would be better off selling, collecting the net proceeds (which would be tax free for most), and reset on their finances.

Source: CoreLogic

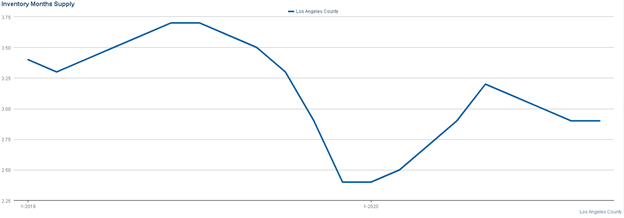

2) Inventory remains extremely low. For Los Angeles County, the average month’s supply has hovered around the 3 months mark since July. This is important to note because this means if no new homes came to the market, it would only take 90 days for all homes to sell. To have a balanced market would be at 6 months. In other words, we would need double the inventory to create a balanced market and that does even mean massive price reductions.

Source: Info Sparks/Multiple Listing Service

Why is this important? It is because even if distressed homeowners put their homes on the market, they may get quickly absorbed and sold before we can see a major impact. What we saw in the housing crash was a mass influx of inventory. In this round, it may be more a trickle in that will quickly get eaten up by multiple offers. We are seeing as little as two to four offers and as many as over 30 offers just on one property. That means 29 other buyers chomping at the bit.

3) Housing is more important now than ever. Major companies such as Dropbox, Facebook, Google, Microsoft, and more are allowing their employees to work from home. So now people went from spending 6 waking hours at home during the week to 16+. Things like a home office, outdoor space, and a backyard are becoming more important. This means that people are going to start making moves. It explains why people are leaving more congested areas such as high-rise apartments and heading to the suburbs. In some cases, people are heading out of state if they can maintain close to their current salaries.

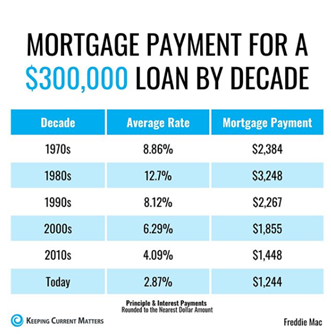

4) This, plus the low interest rates, have been keeping buyers literally on the move and buying. Even though home prices have gone up over time because interest rates have decreased, it means people can afford a higher price point because their monthly payments would be the same or less. Think of your mortgage payment like a pie, where a portion of it is the interest rate and another portion is the principal balance of what you are borrowing. If someone can qualify for $3,000/month, the more of that can go towards a principal rather than interest means an increase purchasing power. Below is a chart put together by Keeping Current Matters using data from Freddie Mac outlining interest rates by decades. Payments have literally cut in almost half from when many of our parents bought their first home to you buying yours. Now of course a $300,000 loan amount in the 70s did go a lot farther than it does today, so account for inflation. It is more for illustrative purposes.

5) Homeowners have options. Back when the crash occurred, homeowners didn’t have a lot of options when it came to working with the bank. That’s changed. Some of the options include:

- Traditional Refinance: Assuming the homeowner is still employed because interest rates are so low, borrowers have the option to refinance into lower payments, making it more affordable and less incentive to move (keeping overall inventory low).

- Repayment Plan: Some lenders are allowing an increase in payments to pay off what is due. This could be an interesting option if a borrower can couple it with the lower interest rate.

- Deferral Program: Some borrowers can shift their payments to the end of the loan. Yes, their balance does not decrease, but at least they can keep their homes without having to come out of pocket with what’s due.

- Flex Modification: This is a program provided by both Fannie Mae and Freddie Mac. This is like a refinance but for those that have been behind on their mortgage (typically between 60-90 days).

Of course, we will see what happens. As some business open and people go back to work, it means they can catch up on their payments and it is business as usual. I just wouldn’t bank on seeing massive foreclosures.

No responses yet